Money management skills: The key to financial freedom

Published by MAXSolutions on April 19, 2023

Managing money can be difficult, especially when you have bills to pay and a limited income. However, with the right money management skills, you can make the most of your money and achieve financial freedom.

Let’s look at the money management skills that can help you take control of your finances and create a better future.

What are money management skills?

Money management skills are the abilities and knowledge required to manage your finances effectively. It includes skills such as budgeting, saving, investing, and debt management. By developing these skills, you can create a sustainable financial plan that will enable you to meet your financial goals and live the life you want.

Why is money management important?

Having good money management skills is essential for a number of reasons:

It helps you live within your means: By learning how to budget and track your spending, you can avoid overspending and ensure you live within the income available to you.

Enables you to save money: Good money management skills can help you save money for emergencies, future expenses, and long-term financial goals.

Allows you to invest wisely: Investing can help you grow your wealth over time, but it requires knowledge and skill to make smart investment decisions.

Helps you manage debt: Debt can be a major obstacle to financial freedom, but with good money management skills, you can learn how to manage and pay off your debts.

Improves your financial wellbeing: With good money management skills, you can reduce financial stress and improve your overall financial wellbeing.

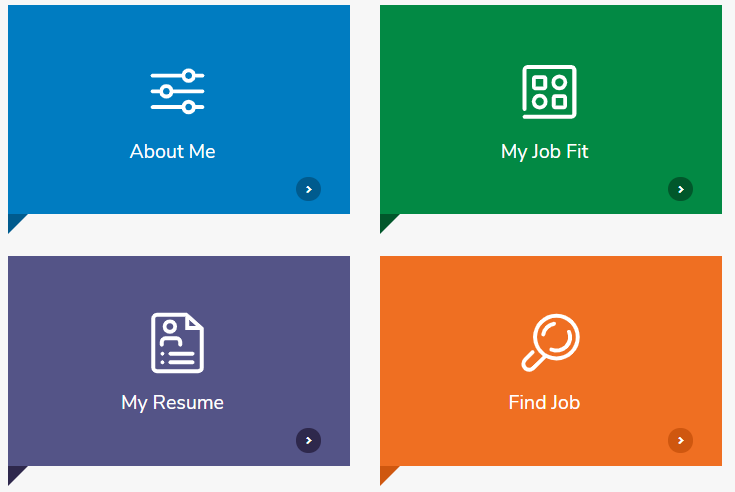

How do you improve your money management skills?

Here are some of the essential skills you need to help you improve your money management.

Budgeting

Creating a budget is the first step in managing your money effectively. It involves tracking your income and expenses and ensuring that you don't spend more than you earn. By creating a budget, you can identify areas where you can reduce your spending and increase your savings.

Saving

Saving money is an essential part of financial management. It involves setting aside money for emergencies, future expenses, and long-term financial goals. By saving regularly, you can build up a financial safety net and work towards achieving your financial goals.

Investing

Investing can help you grow your wealth over time, but it requires knowledge and skill to make smart investment decisions. By learning about different investment options and understanding risk and return, you can make informed decisions and achieve your financial goals.

Debt management

Managing debt is an essential part of money management. It involves understanding your debt obligations, creating a plan to pay off your debts, and avoiding new debt. By managing your debt effectively, you can reduce financial stress and achieve financial freedom.

Financial planning

Financial planning involves setting financial goals and creating a plan to achieve them. By identifying your financial goals and creating a roadmap to achieve them, you can work towards achieving financial freedom.

A financial literacy short course to help build your money management skills

At MAX we understand the importance of good money management and the impact having strong financial literacy can have on your life.

That's why our RTO (0667) has launched a new Financial Literacy Short Course (FNSFLT211) that can help you develop essential money management skills. The course covers topics such as personal budgeting, taxes, superannuation, and insurance, and aims to raise awareness of financial literacy and its benefits.

The course can be studied online or in a classroom setting.

Blended learning takes place over five x 5.5 hour sessions, totalling 27.5 hours, and includes real-life scenarios to help you apply your learning.

Upon completion of the course, you will have gained money management skills to help you into the future.

Recent course participant Yvonne shared about her experience in the Financial Literacy Short Course:

Share

Tags

Found this useful?

Help and advice

Our blogs are about helping people seek the information that they need for their steps in the workforce.

_1.jpg)

.jpeg)